How to Minimize Taxes of Social Security Benefits

Nov 11, 2019 • Written by Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

Blog Home » Retirement Income » How to Minimize Taxes of Social Security Benefits

Many people are surprised to find out their Social Security income is subject to taxes in retirement. There are a variety of factors that determine whether your Social Security benefit will be taxed in retirement Taxation of Social Security Income.

Consider each of these strategies to minimize taxes on your Social Security benefits.

- Stay below the taxable thresholds

- Manage your other retirement income sources

- Consider taking IRA withdrawals before signing up for Social Security

- Save in a Roth IRA

- Donate Your RMD to Charity

Stay Below the Taxable Thresholds

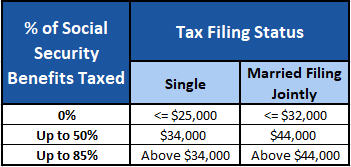

Social Security benefits become taxable if the sum of your adjusted gross income, nontaxable interest and half of your Social Security benefit exceeds $25,000 as an individual and $32,000 as a married couple. If these income sources are between $25,000 and $34,000 ($32,000 and $44,000 for couples), income tax will be due on 50% of your Social Security benefit. Retirees with incomes that exceed $34,000 ($44,000 for couples) pay income tax on up to 85% of their Social Security benefit.

Knowing – and planning around – these thresholds can help reduce your retirement income subject to taxation.

Manage Your Other Retirement Income Sources

Retirees who have income from other sources in addition to Social Security frequently have to pay tax on part of their Social Security benefit. Pension payments, dividends and interest from savings and investments, earnings from a part-time job and withdrawals from traditional 401(k)s and IRAs are sources of retirement income that can contribute to making your Social Security payments taxable.

Consider Taking IRA Withdrawals Prior to beginning Social Security

You have some control over when to take withdrawals from retirement accounts during your 60s because you can begin taking penalty-free distributions after age 59 1/2 but aren’t required to take minimum withdrawals (RMDs) until after age 70 1/2. You might be able to reduce your Social Security income tax bill if you withdraw money (or perform Roth conversions) from your traditional 401(k) or IRA in the years before you sign up for Social Security.

For many retirees, changing the order they tap their savings to generate income can minimize taxes on Social Security. Many middle-income retirees should consider withdrawing their IRA account first before starting Social Security. This reduces their IRA account balance by the time required minimum distributions start, and many times the amount of Social Security taxes that typically increase as retirees withdraw more IRA money at the age of 70 and beyond.

Some retirees take a large retirement account distribution in the year before signing up for Social Security, while others take IRA distributions for several years in order to delay claiming Social Security and qualify for higher Social Security payments in the future. Managing or controlling your income for a particular year means timing withdrawals other than required minimum distributions such that the income for the year is stacked in one year, with the following or preceding year having a lower amount of distribution income.

Save in a Roth IRA

Distributions from Roth 401(k)s and Roth IRAs after age 59 1/2 from an account at least 5 years old are not taxable and don’t contribute to the taxation of your Social Security benefits. Saving for retirement in an after-tax Roth account sets you up for tax-free withdrawals in retirement, and also allows you to minimize taxes on your Social Security payments. Money that comes out of Roth IRA accounts is not included in the calculation that determines how much of your Social Security is subject to taxation. By the time you begin Social Security, if you have more money in Roth IRAs, and less money in tax-deferred accounts, you will have more flexibility in when you draw money out of what type of account. With planning, you can draw money out in a way that reduces your tax liability over the course of your retirement years.

Donate Your RMD to Charity

After age 70 1/2, you might be able to avoid paying income tax on your IRA required minimum distribution if you donate it directly to a qualifying charity. You are able to give up to $100,000 each year tax-free to charity from your traditional IRAs. The gift counts as your required minimum distribution but isn’t included in your adjusted gross income. Making this direct transfer from your IRA to charity (called a “qualified charitable distribution” or “QCD”) keeps your RMD out of the provisional income calculation and could help you stay below the cutoffs that determine what portion of your Social Security benefits is taxable.

Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

Paul Staib, Certified Financial Planner (CFP®), RICP®, is an independent Flat Fee-Only financial planner. Staib Financial Planning, LLC provides comprehensive financial planning, retirement planning, and investment management services to help clients in all financial situations achieve their personal financial goals. Staib Financial Planning, LLC serves clients as a fiduciary and never earns a commission of any kind. Our offices are located in the south Denver metro area, enabling us to conveniently serve clients in Highlands Ranch, Littleton, Lone Tree, Aurora, Parker, Denver Tech Center, Centennial, Castle Pines and surrounding communities. We also offer our services virtually.

Read Next

2016 Year End Tax Tips

• Written By Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

If tax time brings you stress, read on. First, take heart that you can act before the end of the…

Personal Financial Records Retention Suggestions

• Written By Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

When it comes to financial records retention and records retention guidelines, there aren’t any hard and fast records retention guidelines. …