TAXATION OF RETIREMENT INCOME

Sep 2, 2014 • Written by Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

Blog Home » Financial Planning » TAXATION OF RETIREMENT INCOME

A Summary of How Your Retirement Income is Taxed

Retirees often receive income from a variety of sources, including Social Security benefits, and distributions from pensions, annuities, IRAs and other retirement plans. It’s critical to understand the taxation associated with each of these income sources in order to minimize the impact taxes will have on an overall income plan. Tax planning can help save you money and is increasingly important to do it when you get to the point where you are considering withdrawing money in retirement.

In order to plan ahead properly, you’ll need to understand how your retirement income will be taxed. Armed with that knowledge, you can choose the right strategies to keep your tax bill as low as possible. Below is a summary of the tax treatment of various retirement income sources.

Social Security Benefits

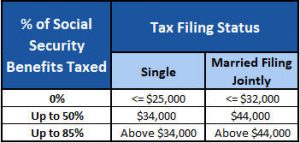

Up to 85% of Social Security benefits may be taxed at your ordinary income rate.

- For Singles:

- Income less than $25,000, benefits not taxed;

- Income $25,000 – $34,000, 50% of benefits taxed;

- Income over $34,000, 85% of benefits taxed

- For Married filing jointly:

- Income less than $32,000, benefits not taxed;

- Income $32,000 – $44,000, 50% of benefits taxed;

- Income over $44,000, 85% of benefits taxed

For planning purposes, you should have an idea of whether your retirement income will cause some of your Social Security benefits to be taxed. Taxation of Social Security Income

Pension and Annuity Income

Your pension or annuity income will be fully or partially taxable as ordinary income, depending on whether contributions were tax-deferred or not. If all contributions to the pension were tax-deferred, then your distribution will be fully taxable as ordinary income. If you contributed some after-tax dollars to fund your plan, then you have some cost basis in the plan contract. Part of your distributions will be a tax-free recovery of your cost basis, and the remainder will be taxable income as ordinary income. IRS Publication 575, Pension and Annuity Income, provides comprehensive information about figuring the taxable amount.

Pension and annuity income is reported to you using IRS Form 1099-R. Your plan administrator should calculate the taxable portion of your pension distribution. For planning purposes, you will want to contact your plan administrator to find out what your pension payments will be, and what part of the payments will be considered taxable income.

Traditional 401(k), 403(b), or other Employer-Sponsored Plan Distributions

Contributions made with pre-tax dollars are fully taxable as ordinary income upon withdrawal.

Traditional IRA Distributions

Distributions from your traditional individual retirement account (IRA) may be fully taxable or partially taxable depending on the type of IRA you have.

Deductible Contributions – If you have a deductible Traditional IRA, your distributions will be fully taxable as ordinary income. You contributed funds using tax-deductible dollars, and tax is deferred on both the contributions and the earnings until they are withdrawn. Rollover IRAs sourced from 401(k) (or other comparable employer sponsored plans) plans are considered deductible traditional IRAs.

Non-Deductible Contributions – If you have any basis in a non-deductible Traditional IRA, your distributions will be partially taxable. A portion of your distribution represents a return of your non-deductible investment, and that portion is recovered tax-free. All earnings are taxable as ordinary income.

Roth IRA and Roth 401(k) Distributions

Distributions from Roth IRAs and Roth 401(k)s are completely tax-free provided you are age 59½ or older and you’ve held the account for at least five years.

Taxable Account Withdrawals

Capital Gains rates apply. Gains on short-term investments (held for less than a year) are taxed as ordinary income. Gains on long-term investments (held for one year or more) are currently taxed at 15% (or 0% if you’re in the 10 percent or 15 percent income bracket).

Required Minimum Distributions (RMDs)

Taxpayers must begin withdrawing funds from their 401(k) and Traditional IRA plans once the taxpayer reaches age 70½. Distributions must start “by April 1 of the year following the year in which you reach age 70½.” The minimum amount that must be distributed is your account balance divided by the life expectancy figures published by the IRS in Publication 590. Plan to withdraw at least the minimum amount required from your Traditional IRA and 401(k) accounts. Roth IRAs and designated Roth 401(k) accounts are not subject to the minimum required distribution rules.

Summary

Because future tax rates are unknown and subject to fluctuation, it’s near impossible to accurately predict what any of us will be paying in income taxes in the future. But while your tax rate may be uncertain, understanding how different types of income are taxed in retirement can help you begin to formulate an overall retirement income plan. Considering each of the individual components of your overall retirement income plan can help you make tax-smart decisions when it comes time to draw from your various retirement income sources. With numerous variables to consider, there is no easy formula for calculating your income taxes in advance. But a little planning can go a long way in helping to manage and control your tax burden.

Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

Paul Staib, Certified Financial Planner (CFP®), RICP®, is an independent Flat Fee-Only financial planner. Staib Financial Planning, LLC provides comprehensive financial planning, retirement planning, and investment management services to help clients in all financial situations achieve their personal financial goals. Staib Financial Planning, LLC serves clients as a fiduciary and never earns a commission of any kind. Our offices are located in the south Denver metro area, enabling us to conveniently serve clients in Highlands Ranch, Littleton, Lone Tree, Aurora, Parker, Denver Tech Center, Centennial, Castle Pines and surrounding communities. We also offer our services virtually.

Read Next

Financial Advice…on an Index Card

• Written By Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

Harold Pollack, a professor of public policy at the University of Chicago, generated a good deal of buzz a few…

Identity Theft

• Written By Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

Protect Yourself From Identity Theft and Other Scams As hard as you work to make money and as difficult as…