4 Factors Affecting Retirement Withdrawal Rates

May 2, 2023 • Written by Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

Blog Home » Retirement Planning » 4 Factors Affecting Retirement Withdrawal Rates

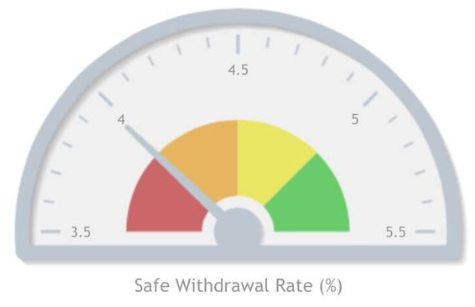

Retirement withdrawal strategies may seem simple, but managing an appropriate retirement income withdrawal rate to balance competing goals is one of the most challenging aspects of retirement income planning. History demonstrates that the “optimal” retirement withdrawal rate depends on several key variables. Unfortunately, many of these factors are unpredictable and beyond a retirees’ control.

Moreover, a retiree’s choice of withdrawal rate has significant implications on their retirement income, and the corresponding level of retirement risks. Using too high of a withdrawal rate increases the risk of prematurely depleting your portfolio during your lifetime (the #1 fear of most retirees). Conversely, using too low of a withdrawal rate unnecessarily lowers your standard of living in retirement. Neither scenario is ideal.

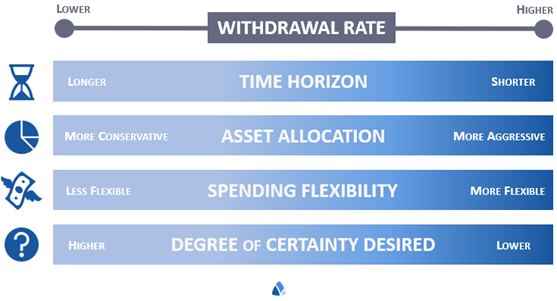

Factors Affecting Your Retirement Withdrawal Rate

Four primary factors affect how much can be spent from the portfolio: the retiree’s time horizon or life expectancy, asset allocation, annual spending flexibility, and degree of certainty that the portfolio won’t be depleted before the end of the time horizon. The accompanying graphic highlights these variables and their effect on portfolio withdrawal rates.

Time Horizon

The longer the anticipated time horizon, the lower the initial spending rate should be. The shorter the horizon, the more spending the portfolio is likely able to sustain. For example, a 60-year-old retiree with a 30-year planning horizon should utilize a lower withdrawal rate (as a percentage of the overall investment portfolio) than an 85-year-old retiree with a 10-year horizon. As a retiree progresses through retirement, the withdrawal rate can incrementally increase to reflect the reduced planning duration. With few exceptions, most retirement income withdrawal strategies utilize higher withdrawal rates as time passes.

Asset Allocation

Generally, for retirees with 15+ year planning horizons, the more conservative the asset allocation, the lower the expected return over the time horizon and the lower the withdrawal rate. With some caveats, the more aggressive the asset allocation, the higher the sustainable withdrawal rate. As the equity percentage approaches 100%, return volatility will likely increase. The increased volatility associated with a higher equity allocation may increase the chance of running out of money. Based on the long-term history of market performance for periods of 20+ years, an equity allocation in the 50%-75% range often maximizes sustainable withdrawal rates.

Over shorter time horizons, employing a more aggressive equity allocation in retirement may not enable meaningfully higher withdrawal rates. As such, retirees with shorter time horizons (of 10 to 15 years, or fewer) can often employ a higher withdrawal rate if using a conservative portfolio mix than they can with a more equity-heavy one.

Spending Flexibility

Retirees who can incorporate flexibility into their annual spending needs are able to set higher initial portfolio withdrawal rates.

The third factor, spending flexibility, is the proportion of total expenses attributable to discretionary versus nondiscretionary spending. What is the minimum income needed from the portfolio to live on after accounting for ongoing income sources such as Social Security, pension(s), or other forms of “guaranteed” income? In general, the greater the proportion of expenses that can be eliminated or reduced in any given year, the greater the level of spending flexibility. For example, a retiree whose leisure and entertainment (discretionary expenses) take up a large portion of each year’s expenses may be better able to endure a reduction in portfolio-based income. In contrast, a retiree who is more reliant on income from their portfolio to cover their essential expenses would have significantly lower spending flexibility, and therefore may consider utilizing a lower withdrawal rate. Retirees who can incorporate flexibility into their annual spending needs are able to set higher initial portfolio withdrawal rates and are often good candidates for using a Guardrails approach to retirement income planning.

Degree of Certainty Desired

The fourth element is the desired degree of certainty regarding the chance for premature portfolio depletion. This is the likelihood that the portfolio will last for the investor’s entire time horizon or life expectancy. The higher the preferred degree of certainty (the more conservative one is), the lower the spending rate. For example, a married couple with children/grandchildren with significant legacy inheritance objectives may have a higher desired degree of certainty relative to a single retiree whose primary objective is maximizing their standard of living in retirement.

SUMMARY

Retirement income withdrawal rates are affected by many factors, but four of the more critical ones are a retiree’s time horizon, asset allocation, spending flexibility, and degree of certainty. These factors, in conjunction with a retiree’s personal goals, should be considered when determining a retirement income withdrawal rate.

It’s important to acknowledge that these factors (and others) evolve over time and affect the appropriateness of a given withdrawal rate. Utilizing a Dynamic Withdrawal Strategy (Guardrails) to manage and monitor your retirement income plan – including making disciplined and well-thought-out periodic adjustments – is critically important to maximizing your standard of living in retirement while managing risks.

Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

Paul Staib, Certified Financial Planner (CFP®), RICP®, is an independent Flat Fee-Only financial planner. Staib Financial Planning, LLC provides comprehensive financial planning, retirement planning, and investment management services to help clients in all financial situations achieve their personal financial goals. Staib Financial Planning, LLC serves clients as a fiduciary and never earns a commission of any kind. Our offices are located in the south Denver metro area, enabling us to conveniently serve clients in Highlands Ranch, Littleton, Lone Tree, Aurora, Parker, Denver Tech Center, Centennial, Castle Pines and surrounding communities. We also offer our services virtually.

Read Next

When It Pays to Retire With a Mortgage

• Written By Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

Sometimes retiring with a home you own free and clear isn’t the best choice. If you’re in or near retirement…

New Year’s Financial Resolutions: Get Your Finances in Shape

• Written By Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

Many people make resolutions on New Year’s Day. But no matter what your resolutions are, the key isn’t making the list, it’s…