Determining a Realistic Withdrawal Amount and Asset Allocation

May 29, 2019 • Written by Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

Blog Home » Asset Allocation » Determining a Realistic Withdrawal Amount and Asset Allocation

Most people look forward to retirement, but it can be one of the most complicated stages of life from a financial planning point of view. In addition to charting a suitable investment strategy, retirees need to consider estate planning issues, health insurance needs, and – one of the most critical decisions – how much they can afford to spend without jeopardizing their future financial security.

The results presented within this article were produced using Monte Carlo simulations. Without going too far into the weeds, a Monte Carlo simulation is a method of testing an outcome over a range of possible variables – think of it as a “stress test” of your financial future. Monte Carlo simulations are commonly used in retirement planning to predict the likelihood that you will have a particular level of retirement income through your life expectancy. When used for retirement planning purposes, it’s common practice to target an 80% or greater probability of success; with “success” defined as having at least $1 remaining in the portfolio at the end of the retirement period.

There are several variables to consider, however the purpose of this Monte Carlo analysis is to illustrate the importance of three of the most critical variables in Retirement Income Planning:

- Withdrawal Rates (the amount you withdraw annually, expressed as a % of the total aggregate portfolio)

- Planning Durations (the number of years in retirement),

- Asset Allocation (the mix of stocks and bonds, which ultimately determines your investment rate of return)

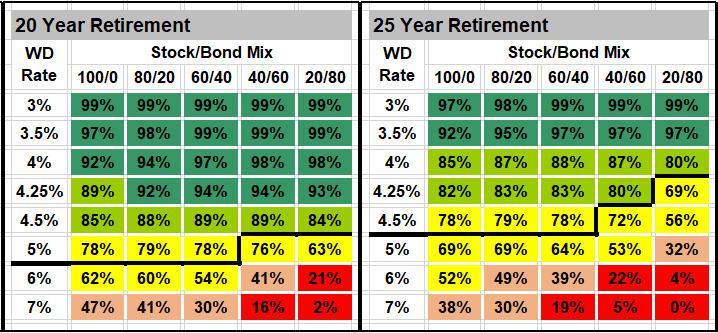

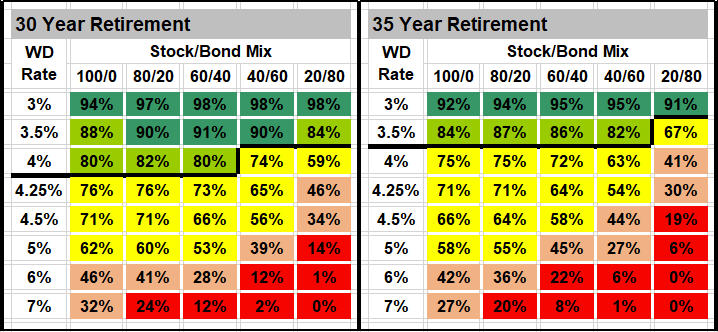

The Monte Carlo results below contain the estimated probability (simulation success rate) of maintaining various spending rates throughout retirement, depending on the investor’s initial withdrawal amount (ranging from 3% to 7%), time horizon (20, 25, 30, and 35 years), and asset allocation (ranging from 100% Stocks/0% Bonds to 20% Stocks/80% Bonds). The analysis reflects a broad range of investment and spending strategies tested over 100,000 possible scenarios of market performance. Because it’s expressed as a withdrawal % of the total portfolio, the guidelines can be applied for any amount of retirement assets (i.e. 4% of $400k or 4% of $2mm).

As an example of reading the results, an investor would have an 82% probability of not depleting their savings if they used a 4% withdrawal rate for 30 years and had an 80% Stocks / 20% Bonds asset allocation. The probability of success would be reduced to 74% using the same 4% withdrawal rate for 30 years, but having a 40% Stocks / 60% Bonds asset allocation.

Several observations can be made from studying the simulation results:

- Perhaps stating the obvious, success rates ALWAYS are higher for lower withdrawal rates and shorter planning durations – you’re taking less money from the portfolio for a shorter period of time

- Success rates are most often higher – but not always – with higher stock allocations. Higher stock allocations are required to improve success rates for relatively higher withdrawal rates and relatively longer planning durations

- Success rates are most sensitive to Withdrawal Rates and least sensitive to asset allocation. Managing your spend (i.e. withdrawal rate) is the single most important (and controllable) variable for retirement success

- Withdrawal Rates <=~4% result in desired results (>=~80% success rate) across all time horizons <=~30 years with a >=50% Stock allocation; Withdrawal Rates in excess of ~5% are problematic across all planning durations; and results from Withdrawal Rates between ~4%-5% vary significantly based upon time horizon, and to a lesser extent, asset allocation

- A retiree’s “optimal” Asset Allocation can be derived based upon Withdrawal and Duration planning targets. NOTE: in certain cases, a more conservative asset allocation results in higher likelihood of success, especially for relatively shorter planning durations and lower withdrawal rates

Many retirees may have to make trade-offs between how much they can spend, the likelihood that they will be able to sustain assets in retirement, and the investment risk they are willing to take. Armed with an understanding of the Monte Carlo results above, retirees can customize an asset mix and initial withdrawal amount to coincide with their specific requirements.

Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

Paul Staib, Certified Financial Planner (CFP®), RICP®, is an independent Flat Fee-Only financial planner. Staib Financial Planning, LLC provides comprehensive financial planning, retirement planning, and investment management services to help clients in all financial situations achieve their personal financial goals. Staib Financial Planning, LLC serves clients as a fiduciary and never earns a commission of any kind. Our offices are located in the south Denver metro area, enabling us to conveniently serve clients in Highlands Ranch, Littleton, Lone Tree, Aurora, Parker, Denver Tech Center, Centennial, Castle Pines and surrounding communities. We also offer our services virtually.

Read Next

What’s In Your Credit Score

• Written By Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

Credit scoring has been in existence since the late 1950s, when it was first used by large retail stores and…

MEDICARE: IRMAA

• Written By Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

KEY TAKEWAYS IRMAA is tax surcharge that high-earning Medicare beneficiaries have to pay each month IRMAA is determined based on…