Coronavirus Aid, Relief, and Economic Security (CARES) Act: A Summary

Mar 28, 2020 • Written by Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

Blog Home » Retirement Planning » Coronavirus Aid, Relief, and Economic Security (CARES) Act: A Summary

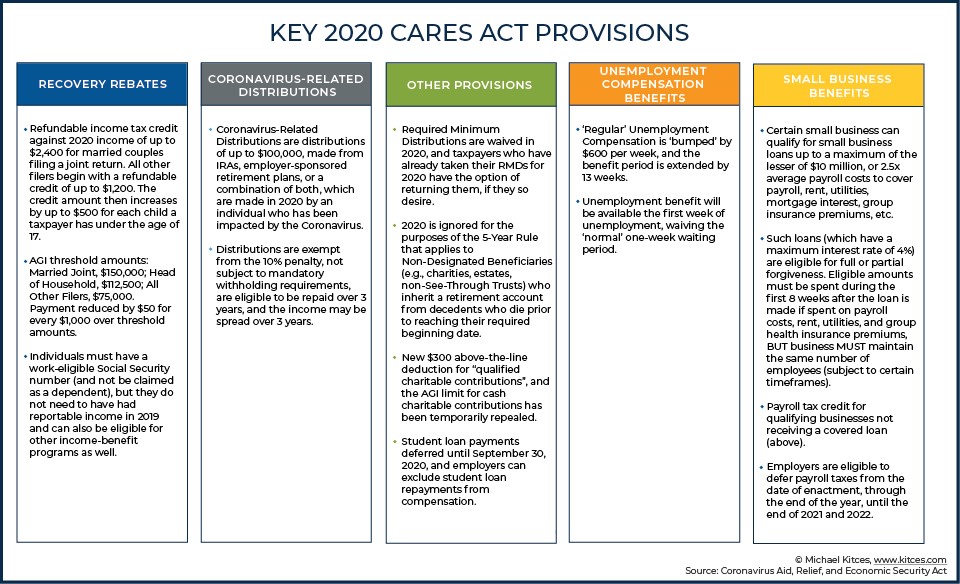

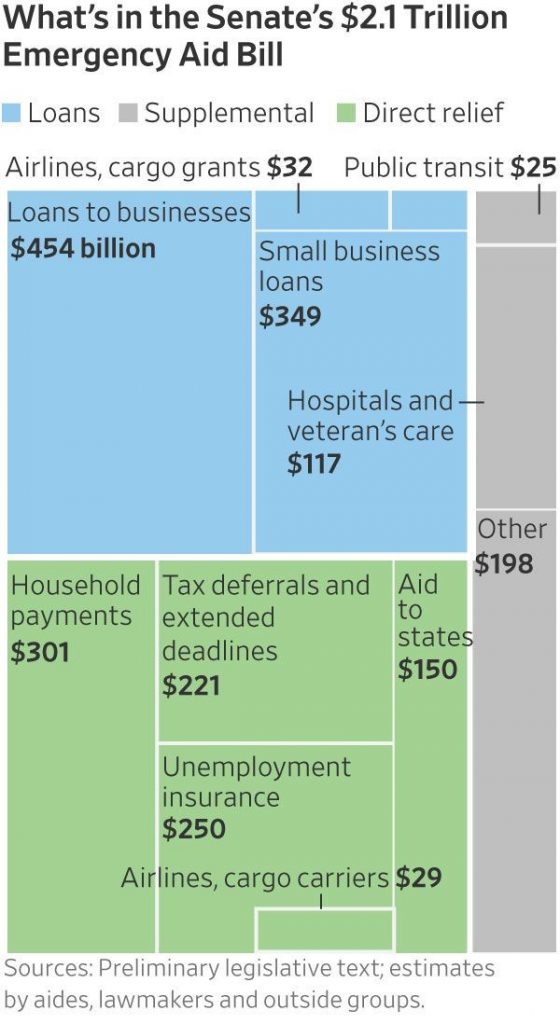

In response to the unfolding COVID-19 global pandemic, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, a $2+ trillion emergency fiscal stimulus package, has been enacted in order to help ease the effects of the resulting economic damage. The CARES legislation includes a wide range of provisions for both loans and outright rebate payments or tax credits aimed at helping individuals, businesses, healthcare entities, and state and local governments meet short-term cashflow demands. Below are several highlights of the Act’s provisions.

Direct Payments to Taxpayers

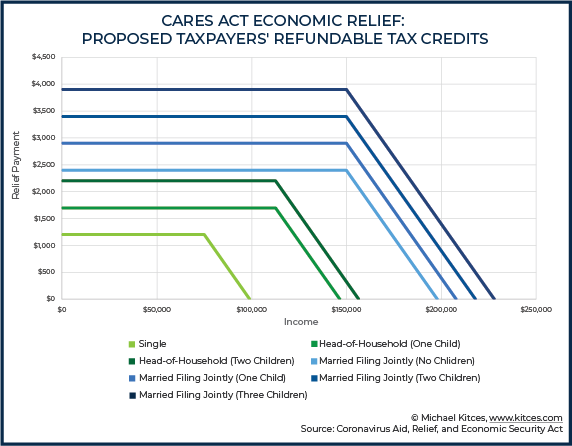

One of the most notable provisions in the bill is the direct payments to taxpayers. Specifically, individuals who had up to $75,000 in adjusted gross income (AGI) in 2019 will receive a one-time payment of $1,200, while married couples with AGI up to $150,000 will receive $2,400. Additionally, taxpayers will receive an additional $500 for each qualified child, while individuals and families with income above their respective thresholds will see their relief payments reduced by $50 for every $1,000 in AGI. Notably, while individuals must have a work-eligible Social Security number (and not be claimed as a dependent), they do not have to have had reportable income in 2019 and can also be eligible for other income-benefit programs as well. As a taxpayer’s income begins to exceed their applicable threshold, their potential payment begins to phase out. More specifically, for every $100 a taxpayer’s income exceeds their credit, their potential rebate will be reduced by $5.

You can utilize this simple calculator from Kiplinger to estimate your stimulus check: Stimulus Payment Calculator

Here’s a post on how best to utilize your stimulus check

Elimination of 2020 Required Minimum Distributions (RMDs)

The CARES act includes the waiver of required minimum distributions (RMDs) in 2020 for a wide variety of retirement accounts (for both account owners as well as beneficiaries) as well as the ability to return current-year distributions. Refer to this post for additional details: CARES Act Waives Required Minimum Distributions (RMDs) from Retirement Accounts for 2020

Retirement Planning Savings Account – Early Distributions

The CARES Act allows people younger than 59½ to take an early distribution from a traditional IRA or company retirement plan to pay for a coronavirus-related hardship, such as a job loss. Specifically, the legislation removes the 10% penalty that normally applies to hardship withdrawals from company retirement plans and IRAs, up to $100,000, for affected individuals. It also gives individuals who have taken a hardship withdrawal due to COVID 19-related issues the option to pay the funds back over three years and to split the income associated with the withdrawal (and the associated tax burden) over three years as well. It’s important to note that withdrawals of up to $100,000 from 401(k)s and IRAs skirt the 10% penalty but not the ordinary income taxes that are due on any withdrawal of tax-deferred assets.

Additionally, the act increases the allowable loan amount from employer-sponsored retirement plans to $100,000 from $50,000 for people who have been affected by the coronavirus.

IMPORTANT: While the CARES Act makes it easier to gain access to retirement accounts, that doesn’t mean you should utilize it. In fact, your retirement accounts should be used a last resort. This blog post details better sources for emergency cash: Sources of Emergency Cash.

Unemployment Related Provisions

For the millions of Americans who lose employment as a result of the pandemic, the CARES Act includes the following key provisions:

- Unemployment benefits will be available the first week of unemployment, waiving the “normal” one-week waiting period;

- Increase in compensation of $600 per week for unemployment benefits for up to four months;

- Extension of the maximum duration of unemployment by 13 weeks;

- Expansion of benefits for those who would otherwise not normally qualify for benefits (such as self-employed individuals and independent contractors);

Small Business Provisions

With respect to small businesses that have been impacted by COVID-19, certain small businesses with up to 500 employees will be able to take out loans (up to $10M depending on payroll costs and other factors), which will be eligible for forgiveness if used to cover payroll and other expenses (like rent and utilities), along with other ‘employee retention’ tax credit opportunities. Other benefits for businesses include a delay in the employer’s portion of Social Security payroll tax until January 1, 2021 (with half of the deferred amounts due at the end of 2021, and the other half due at the end of 2022), and more flexible Net Operating Loss rules to obtain immediate refunds, among others.

Emergency Lending

Beyond benefits for individuals and businesses, the CARES Act provides for $454 billion in emergency lending, not only to states and municipalities, but to airlines and other businesses critical to US national security, and another $150 billion allocated proportionally to state and local governments to offset amounts used to respond to the pandemic.

CARES Act Summary

In summary, the CARES Act is a historic emergency relief program for Americans and provides much-needed assistance for those affected by the pandemic and the resulting economic damage. And with changes in tax laws come planning opportunities.

Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

Paul Staib, Certified Financial Planner (CFP®), RICP®, is an independent Flat Fee-Only financial planner. Staib Financial Planning, LLC provides comprehensive financial planning, retirement planning, and investment management services to help clients in all financial situations achieve their personal financial goals. Staib Financial Planning, LLC serves clients as a fiduciary and never earns a commission of any kind. Our offices are located in the south Denver metro area, enabling us to conveniently serve clients in Highlands Ranch, Littleton, Lone Tree, Aurora, Parker, Denver Tech Center, Centennial, Castle Pines and surrounding communities. We also offer our services virtually.

Read Next

Estimating Your Life Expectancy

• Written By Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

A critically important variable in retirement planning is life expectancy. I occasionally joke with retirement planning clients that if they…

Staib Financial Planning, LLC Receives 2022 Best of Lone Tree Award

• Written By Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

Press Release FOR IMMEDIATE RELEASE Staib Financial Planning, LLC Receives 2022 Best of Lone Tree Award Lone Tree Award Program…