Retirement Withdrawal Strategies

May 2, 2023 • Written by Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

Blog Home » Retirement Planning » Retirement Withdrawal Strategies

Summary

- Retirement Income Planning is Complex and Consequential

- Complex: due to the many critical factors involved in choosing an appropriate retirement income withdrawal strategy, many of which are unpredictable and outside of a retiree’s control

- Consequential: withdrawal too much and you risk prematurely depleting your investment portfolio; withdrawal too little and you will have unnecessarily lowered your standard of living in retirement

- Generally, there are three primary approaches to Retirement Income Planning, each with its own benefits and shortcomings

- While there is no one-size-fits-all optimal strategy for retirees, many retirees may benefit from utilizing a Dynamic Retirement Withdrawal strategy (specifically a “Guardrails” strategy), to fit their personal financial situation and needs

An Overview

It sounds simple, but choosing an appropriate retirement income withdrawal strategy to balance competing goals is challenging. Many critical factors involved are unpredictable and beyond a retirees’ control. For example, retirees have little to no control over:

- Market returns,

- Inflation rates,

- Length of retirement planning horizon (life expectancy),

- Economic conditions, and

- Ever changing tax laws and regulations governing their sources of retirement income…

Yet each of these variables significantly affects how much can be safely withdrawn from a portfolio while preserving the potential to generate income for life.

Numerous retirement withdrawal strategies have been developed to help retirees manage their portfolio income throughout retirement. Each places different emphasis on four fundamental (but competing) priorities many retirees are trying to balance, specifically:

- Minimize (if not eliminate) the possibility of running out of money (retirees #1 greatest fear!);

- Maximize retirement standard of living, especially early in retirement;

- Avoid undesired changes to retiree’s income stream (that is, reductions or freezes); and

- Maintain purchasing power throughout their retirement

Common Retirement Withdrawal Approaches

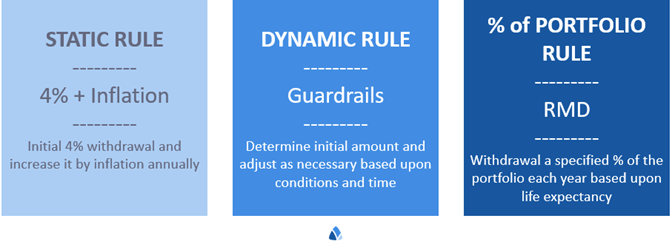

Generally, there are three primary strategies to Retirement Income Planning, each summarized below.

4% Strategy

The 4% rule is a commonly used approach based upon research performed by William Bengen in the mid-1990s. It’s been widely adopted and popularized and is often cited by the media. The 4% rule postulates that for any 30-year retirement, a 4% inflation adjusted withdrawal rate using a 50-75% stock allocation should be reasonably safe for retirees to use. It was designed to provide retirees with a constant, smooth income throughout the retirement period, regardless of market conditions.

The 4% approach entails withdrawing 4% of the investment portfolio in the first year of retirement and increasing that income amount annually by the rate of inflation. For example, let’s say a retiree has a $1 million dollar portfolio their first year of retirement. Using this model, the retiree would withdrawal 4% of the portfolio – or $40,000 ($1,000,000 x 4%) the first year. Year 2 income would increase by the amount of inflation. If inflation was 5%, the retiree’s income in year 2 would increase to $42,000 ($40,000 x 5%). This process of calculating the annual portfolio income would continue throughout retirement, irrespective of market returns.

Dynamic Withdrawal Strategy (Guardrails)

A dynamic retirement income strategy (Guardrails) is an approach that aims to adjust the amount of income withdrawn from retirement savings based on changes in financial market conditions, life events, and other factors that affect a retiree’s changing income needs over time. The basic idea behind this strategy is to adjust the retirement income distribution based on a set of predefined rules, rather than following a static withdrawal rate, such as the 4% strategy.

A dynamic retirement withdrawal strategy typically involves setting a base withdrawal rate from retirement savings and then adjusting the rate up or down as necessary to reflect changes in the retiree’s investment portfolio value, inflation, and other factors that affect retirement income needs. For example, if the market performs well and the value of retirement portfolio increases, the retiree may be able to increase their amount withdrawn. Conversely, if the value of retirement portfolio decreases to a predefined level, the withdrawal rate will need to be decreased to preserve savings and avoid the risk of running out of money in retirement. The pre-defined upper and lower boundaries serve as “guardrails”, ensuring the withdrawals don’t stray “off the road” (become too high or too low) based on changes to a retiree’s circumstances and the market conditions.

% of Portfolio (RMD)

Using this approach, a retiree would withdrawal a specified % of portfolio each year based upon their life expectancy. The % of the portfolio to be withdrawn increases slightly each year, but the actual dollar amount withdrawn is dependent upon the value of the investment portfolio. For example, a retiree would withdrawal ~3.5% of their portfolio at age 70, ~5.0% at age 80, and ~8.2% at age 90. IRS mandated Required Minimum Distributions (RMDs) follow this approach, so retiree’s using this strategy can determine their withdrawals using the IRS provided Uniform Lifetime Table (it is Table 3 on page 65).

Pros and Cons

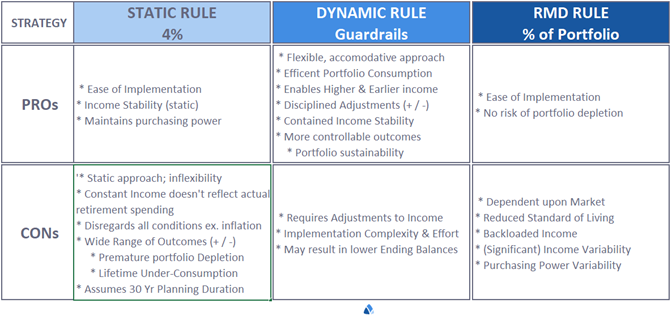

4% Strategy

The benefits of the 4% approach include its ease of implementation, the stability of the income over the retirement duration, and the guarantee of maintaining purchasing power over time due to the income increases being adjusted by the inflation rate each year. However, there are several drawbacks to this approach, the most impactful of which may be the fact that it disregards market performance entirely in determining the annual income. As such, the range of potential planning outcomes is extremely wide. If the market performs well over the retirement period, a retiree may end up with a substantial legacy, whereas if the market performs poorly over the retirement period (especially in the early years), a retiree may be in jeopardy of depleting their portfolio prematurely. Another drawback of the 4% approach is that it assumes a 30-year retirement period and it doesn’t adjust income during retirement to account for different spending levels, two attributes which don’t often reflect reality.

Dynamic Withdrawal / Guardrail Strategy

Retirees who can incorporate flexibility into their annual spending needs are able to set higher initial portfolio withdrawal rates.

By incorporating disciplined income adjustments based on several factors (i.e. market conditions, retiree age, inflation, etc.) the dynamic withdrawal approach to retirement income planning allows for a higher level of retirement income, while minimizing retirement risks of the unknown (longevity, market volatility, inflation, unexpected expense(s)). Retirees who can incorporate flexibility into their annual spending needs are able to set higher initial portfolio withdrawal rates. This can help better position a retiree to meet their near-term financial goals, especially to enable a more active lifestyle earlier in retirement. The disciplined, explicit triggers and corresponding income adjustments used in a guardrail strategy help ensure retirees stay on track throughout their retirement – keeping spending from drifting too high or too low in changing conditions. Additionally, the guardrail triggers and adjustments can be calibrated and tailored to meet a retiree’s personal goals and situation.

Perhaps the biggest con of using a dynamic withdrawal strategy is that it’s relatively complex to monitor and implement year over year. Using a guardrail strategy requires determining an initial withdrawal rate, setting the explicit upper and lower guardrail triggers and the accompanying income adjustments, and managing and monitoring those over time. Due to the complexity and consequences of this, a retiree will likely need to engage a financial advisor specializing in retirement income planning, specifically with experience and expertise using guardrail withdrawal strategies. To use a dynamic withdrawal strategy, it’s also critical that a retiree have the willingness and discipline to make necessary adjustments (specifically, reductions) to their income as necessary.

% of Portfolio

Like the 4% approach, a major benefit of the % of Portfolio approach is the simplicity and ease of implementation. Additionally, there is no risk of a retiree depleting their portfolio with this strategy, as the withdrawal percentage each year never exceeds 16% of the portfolio up to age 100 (if using the IRS tables)! Each year you use the actuarial table based on your age to determine the applicable withdrawal % and calculate withdrawal dollar amount by multiplying it times your prior year ending portfolio balance. Using this method can result in significant volatility of your annual income due to it being dependent upon fluctuations in the market. If your portfolio value increases (decreases) by 15%, then the corresponding income sourced from the portfolio will increase (decrease) by approximately that same amount the following year. As such, this approach may not be ideal for retirees desiring a more stable income year to year in retirement. Another significant drawback to this approach is that retirement income may be higher later in retirement for a retiree (vs early in retirement) due to the withdrawal percentages increasing over time as a retiree progresses through retirement. As mentioned previously, most retirees would prefer their income to be higher earlier in retirement as they have the desire and good health to pursue a more active retirement, including travel.

The table below summarizes the pros and cons associated with each retirement income strategy.

Ultimately, retirees face a trade off with investment spending in retirement as spending more at the present means creating greater risk for needing to reduce spending in the future. Retirees need to consider the consequences of spending too little and spending too much – that is being too frugal or running out of assets. Given its compelling benefits, retirees may wish to consider using a Dynamic / Guardrails strategy based on the flexibility it provides to tailor an approach to their unique circumstances.

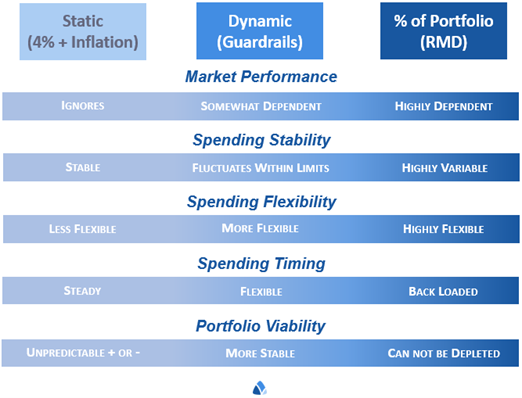

A Comparison of Approaches

The accompanying graphic provides a comparison of the different approaches based upon a spectrum of several differentiating factors. Each of these factors may have a higher relative level of importance for a given retiree. The 4% strategy and the % of Portfolio Strategy are at opposite ends of the spectrum for each of the factors, with the Dynamic Withdrawal / Guardrails strategy as a “hybrid” of the two approaches.

Summary

Because every retiree’s financial situation and personal goal are unique, there is no one single best retirement income withdrawal strategy appropriate for all retirees. Rather, retirees should evaluate and implement a strategy based on their personal goals and preferences across several factors, prioritizing those factors most important them. A retiree’s time horizon, asset allocation, and spending flexibility, and degree of certainty are all important factors to also consider. Regardless of the specific strategy, it’s important to take a rules based, systematic approach when you’re turning your investment portfolio into a paycheck in retirement. Withdrawing money from your investment accounts whenever you need it during retirement can be a recipe for disaster. You could be triggering unnecessary taxes and fees, reducing your rates of return, or even worse, putting yourself at risk of running out of money.

Choose the strategy and approach that works best for you, one that you can understand, and you can commit to implementing and stick with it throughout your retirement. Whatever strategy you choose, the complexity and consequences of the process underscore the need for and value of skillful guidance. You might learn that you need to hire someone to help navigate through this, or you might enjoy managing this puzzle and determine it’s something you can tackle on your own. Whatever you decide, create a system, follow the rules that are backed by academic research, stick with it for the long run, don’t try to outguess the markets or the economy, and have discipline to consistently implement it year over year without getting distracted by external factors.

At Staib Financial Planning, we specialize in helping retiree’s navigate the complexities of retirement, including managing a sustainable retirement income withdrawal strategy. Contact us if we can help you assess and determine a retirement income approach most appropriate for achieving your personal retirement goals.

Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

Paul Staib, Certified Financial Planner (CFP®), RICP®, is an independent Flat Fee-Only financial planner. Staib Financial Planning, LLC provides comprehensive financial planning, retirement planning, and investment management services to help clients in all financial situations achieve their personal financial goals. Staib Financial Planning, LLC serves clients as a fiduciary and never earns a commission of any kind. Our offices are located in the south Denver metro area, enabling us to conveniently serve clients in Highlands Ranch, Littleton, Lone Tree, Aurora, Parker, Denver Tech Center, Centennial, Castle Pines and surrounding communities. We also offer our services virtually.

Read Next

What You Can Learn From Your W-2 Tax Form

• Written By Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

Only employees will receive a W-2. As you review your W-2, here are some of the key line items to…

Financial Planning: Rules of Thumb

• Written By Paul Staib | Certified Financial Planner (CFP®), MBA, RICP®

The expression “rule of thumb” is believed to have derived from carpenters of generations past who used their thumbs to…